Estimated reading time: 11 minute(s)

The new year is here and we’re all ready to put 2020 behind us. Applicable Large Employers are ready to get their ACA reporting behind them as well. Maintaining your ACA compliance is a tedious process and this is the time of year when businesses who have not already begun handling this information, must get started.

At ACAwise, we know the stress that comes with your ACA reporting, so we continue to bring you features that will simplify your reporting process and save you time. The following are our clients’ favorite features that have been a game-changer for their ACA reporting.

Data Integration

ACAwise generates your forms based on the employment information that your business maintains. Sharing your data is simple because we offer many different options. We accept multiple file formats to make your upload process as convenient as possible. Our team of developers can establish API integrations and custom programming to bring your data into our system.

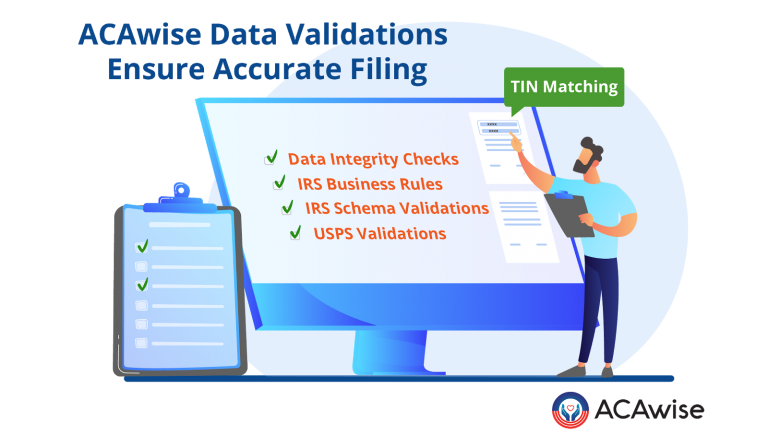

Data Validations

ACAwise performs a variety of validations to confirm the accuracy and consistency of the data. Some of these validations include:

- Data integrity checks

- IRS Business Rule validations

- IRS ACA XML Schema validations

- TIN Matching

- USPS address validation

After performing these validations, our team and yours will be confident that your employee information is accurate and ready to be generated into your forms.

1095 Code Generation

Completing forms with accurate codes is the most important and difficult part of filling out the ACA Forms 1095-C. That’s why ACAwise generates these 1095-C codes for you based on your employee and health insurance coverage information.

Codes on Line 14 are used to indicate the offer of coverage. ACAwise can determine the code that should be used on this line whether you have offered your employees a traditional group health insurance plan or the newer ICHRA plan.

On Line 16, Safe Harbor codes should be used to confirm the affordability of the plan. The ACAwise team can analyze your data to determine your Safe Harbor codes.

Review Forms Through a Secure Portal

Once your forms have been generated, it’s time for you and your team to review them. With ACAwise, this is simple. You and your applicable team members will have access to review the forms directly from your account.

You also have the ability to review the forms offline by downloading them in an Excel format.

IRS E-filing

As an IRS authorized e-file provider, ACAwise is able to e-file your ACA forms 1095-B/C with the IRS via the AIR System.

State E-filing

So far the following states have an individual mandate in place and more are considering the addition of one. The following dates indicate when these mandates went into effect.

- California — Effective January 1, 2020

- District of Columbia — Effective June 30, 2020

- Massachusetts — In effect since 2006

- New Jersey — Effective March 31, 2020

- Rhode Island — Effective January 1, 2020

- Vermont — Effective January 1, 2020

ACAwise can easily e-file your 1095 forms directly to your state both on time and accurately.

Recipient Copy Distribution

With ACAwise, clients can opt into postal mailing and online access. Our team handles the print and mailing of your form copies. With USPS address validations, all of your forms will be mailed to a valid address.

You can also opt for online access. This allows your employees/recipients to view and download their forms from the ACAwise secure online portal.

Form Corrections

The IRS will provide an update on your forms, sometime forms may be rejected or accepted with errors. When this occurs, ACAwise is here to help you through the ACA corrections process. We guide you through correcting, updating, and retransmitting your forms.

Penalty Assessments

The IRS continues to distribute penalty letters to employers, ACAwise is here to help. We can help you address these penalty notices and proceed with the IRS in the most productive way.

Ready to get your 2021 ACA reporting out of the way? Reach out to an expert today! Give us a call at 704.954.8420 or email us at [email protected]!

Learn more about our ACA Core and ACA Elite services today!

Leave a Comment