An Employer’s Guide to IRS Form 1095-C

Here is the key information employers should know about Form 1095-C.

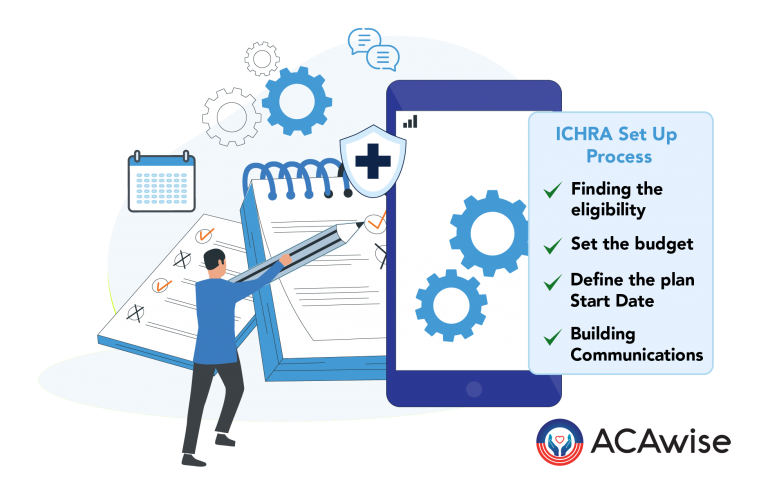

How Do Employers Set Up An ICHRA?

Are you interested in offering your employees an ICHRA, but you aren't sure where to start?

ICHRA: A Complete Guide for Employers

As an employer, there is so much to keep up with in order to maintain your compliance with the IRS. When it comes to meeting your ACA reporting requirements, this...

What Are Safe Harbors Under The ACA?

A Safe Harbor is a method by which employers are able to prove that the health insurance that they offered to their employees was affordable.

What is an ICHRA and How Does it Work?

As this option increases in popularity the IRS will likely require additional information from mandated ACA reporters for tax year 2020.

What Are Safe Harbors Under The ACA?

The ACA requires that applicable large employers (employers with 50 or more full-time equivalent employees) report their health insurance offerings to the IRS. One of the main reasons for this...

You Can Regain Your IRS Reporting Confidence With ACAwise

We admit it…the Affordable Care Act is a very complex piece of legislation. The fact that the mandates and general filing rules required by the ACA are constantly changing does...