Estimated reading time: 9 minute(s)

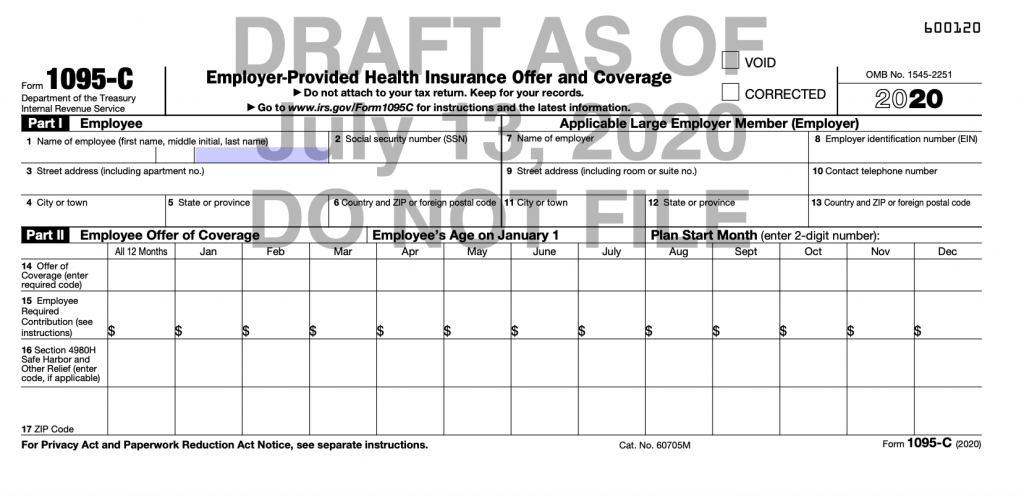

On July 13, 2020 the IRS released new drafts of the ACA Forms 1094-C and 1095-C. As these forms are drafts, it is possible that the IRS will make additional changes to these forms before they are officially released.

Although, in the meantime these drafts are helpful resources for tax professionals and ACA mandated reporters as they plan ahead for next year’s reporting. Here is what you need to know about the changes to these forms for now.

The Form 1094-C remains the same

The Form 1094-C is essentially a cover page that summarizes the information found on the 1095-C. So far, this form remains the same as it’s 2019 counterpart.

Form 1095-C has new codes for HRAs

Following an executive order, employers are now able to use Health Reimbursement Arrangements (HRAs) to reimburse their employees the cost of their health insurance coverage in some circumstances. This order went into effect in January 2020.

More in-depth information on HRAs is available from the IRS at https://www.irs.gov/newsroom/health-reimbursement-arrangements-hras

This is a list of codes that are related to HRAs and should be used on line 14 to indicate the nature of your employees health insurance coverage.

- 1L – Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using the employee’s primary residence location ZIP Code.

- 1M – Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using the employee’s primary residence location ZIP Code.

- 1N – Individual coverage HRA offered to you, spouse and dependent(s) with affordability determined by using employee’s primary residence location ZIP Code.

- 1O – Individual coverage HRA offered to you only using the employee’s primary employment site ZIP Code affordability safe harbor.

- 1P – Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP Code affordability safe harbor.

- 1Q – Individual coverage HRA offered to you, spouse and dependent(s) using the employee’s primary employment site ZIP Code affordability safe harbor.

- 1R – Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

- 1S – Individual coverage HRA offered to an individual who was not a full-time employee.

Line 17 of Form 1095-C is new

The Form 1095-C now has a new line, Line 17. This line indicates the zip code of the employee. This will be used to determine affordability. This applies to employees who were offered an HRA by their employer.

Need a solution for generating your codes?

Understanding the codes used on Form 1095-C is it’s own unique challenge. You may feel like you’re drowning in a sea of single digits and number combinations.

You’re not alone, many errors can occur at this stage of the process. While a 1A and 1E sound pretty similar they indicate different types of health insurance offers on line 14 of the 1095-C. This seemingly small error can add up to a big penalty.

ACAwise was created to correct these types of errors throughout the preparation and filing process. Our software will generate your 1095 forms for you and alert you with any errors.

ACAwise generates these ACA Form 1095-C codes for you using the data that you provide. If you need personalized assistance at any point, our support team is here to guide you through it!

Leave a Comment