Estimated reading time: 9 minute(s)

There have been so many IRS changes to deadlines and forms in 2020, that it has been hard for business owners to keep up. Here at ACAwise, our team of experts pays close attention to all IRS changes that could affect you and your business, so that you won’t be caught off guard.

As of late, the IRS has released some important updates that all mandated ACA reporters should know about, including the extension of an ACA recipient copy deadline.

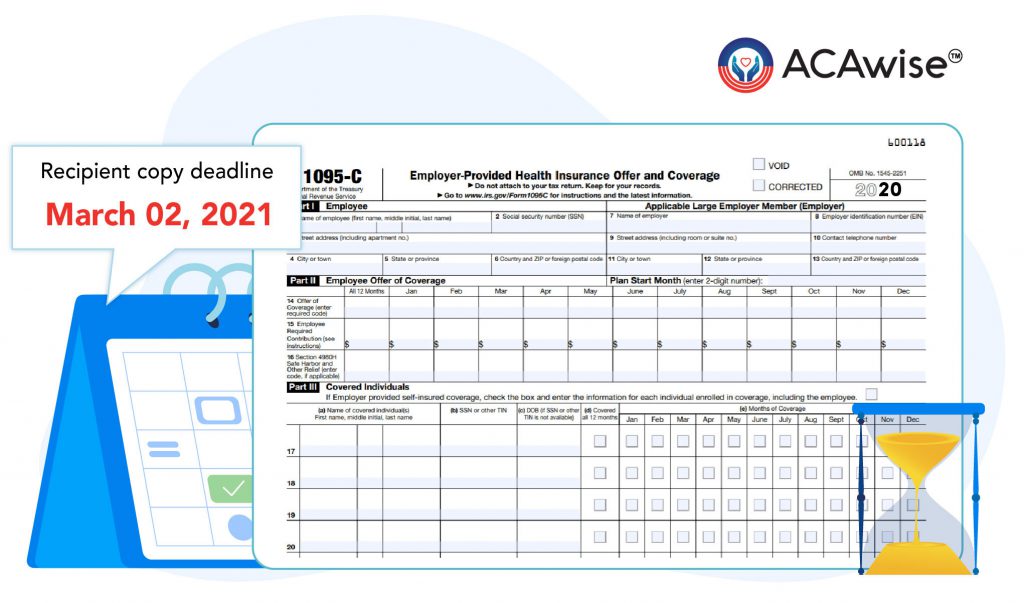

The Updated ACA Recipient Copy Deadline

The IRS has just released Notice 2020-76, with some updated information on the ACA deadlines. This notice refers specifically to the deadline for distributing information returns to recipients.

This deadline was set to be January 31, 2021, however, the IRS has extended this to March 02, 2021. This allows Applicable Large Employers (ALE) and other mandated ACA reporters some additional time to print and mail their recipient copies of Form 1095 and distribute them to their employees.

You can view the full Notice 2020-76 at https://www.irs.gov/pub/irs-drop/n-20-76.pdf.

Click here to learn more about the IRS and State filing deadlines.

Additional IRS Updates

The IRS also released some additional updated information related to ACA reporting on September 10, 2020. These documents are highly technical in nature and provide information about the AIR System, this is how the IRS received e-filed ACA Forms.

These documents contain updated information on IRS business rules, known issues, XML Schemas, and Schema Crossworks.

This information will be especially important when it comes to the mapping of software used to transmit their forms to the IRS.

Form 1095 Draft for 2020

On July 13, 2020, the IRS released a draft of the Form 1095-C to be used for reporting in the 2020 tax year. There are a few key changes that employers should be aware of. While this form is only a draft and therefore not meant to be filed with the IRS, it provides important insights into future ACA reporting requirements.

The most significant change to Form 1095-C refers to the reporting of ICHRAs. Under the current administration, employers are able to offer their employees an Individual Coverage Health Reimbursement Arrangement as opposed to the traditional group health insurance plan.

This means that employees can choose their own health insurance coverage, on the Healthcare Marketplace, for example. The employer will then reimburse their employees with a monthly allowance of tax-free money.

So, how does an employer report an ICHRA plan on Form 1095-C? The revised draft of Form 1095-C has a line dedicated to this information. Line 17, Zip Code, must be completed by any employer that chooses to offer their employees an ICHRA. The IRS will use the employees’ zip code to ensure the affordability of the plan.

There is also a new series of codes to be entered on Line 14, Offer of Coverage, that refers specifically to the ICHRA. Don’t worry, as more IRS updates arrive, our team will continue to keep you updated on changing requirements.

Remember, ACAwise is here to help you complete your ACA reporting accurately. We can help you make a game plan for accurate and timely ACA reporting for tax year 2020.

Leave a Comment