Estimated reading time: 10 minute(s)

As the IRS deadlines creep closer and closer, ACA reporting is on the radar of every mandated filer in the country. With new state filing requirements, many filers are feeling extra pressure this year.

If you are a state mandated filer or just enjoy ACA reporting as much as we do, keep reading!

Which States Are Required To File?

Even The Tax Cuts and Jobs Act eliminates the individual mandate by reducing the penalty to zero starting in 2019, few states such as New Jersey, Massachusetts, California, Vermont and District of Columbia have passed the ACA’s individual mandate to maintain minimum essential coverage.

In 2006, The Massachusetts State became the first state to pass the individual mandate requirement. The States of California and Rhode Island regulate this rule by 2021.

For tax year 2019, these states are required to file to their state agency…

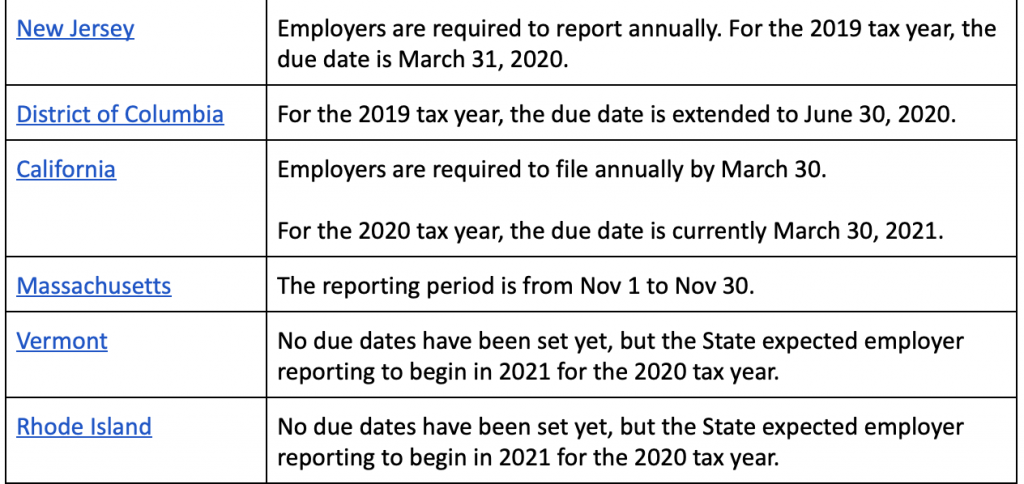

The Reporting Deadlines:

States Reporting Requirements

These states are required to file their 1095-C Forms to their state agencies. The Form 1095-C is the same form that the IRS requires each year.

You may be thinking, “I already filed these forms, this should be easy”. That’s not completely true, even though you have completed these forms, you will put some extra work into figuring out which employees need to be reported to your state. Don’t worry, we’ll break down these complications later on…

Why Are These States Required To File for 2019 Tax Year?

So, why are these states required to file when the vast majority of states are not? Well, there are new ACA policies being implemented in these states. Both New Jersey and DC have put an individual mandate in place.

Since the federal government removed the individual mandate, both New Jersey and DC have decided to re-implement this individual mandate at the state level.

Now all residents of these states must acquire health insurance in order to avoid paying a penalty to their states.

If not meeting Minimum Essential Coverage under New Jersey’s individual mandate, should face an individual tax penalty as high as $3,012. To learn more N.J. Health Insurance Mandate website click here.

For the State of D.C., Individual penalties are equal to 2.5% of salary or $700 per taxpayer. D.C. Health Insurance website click here.

When employers report their employees’ health insurance information to their state agency, the state agencies are able to use this information to determine which individuals are penalized.

Are Employers From Other States Affected?

Yes! This responsibility is not limited to employers who call one of these states home.

Think about it, geographically these states are pretty small and are close to many surrounding states. Therefore, any employer, in any state must report any New Jersey or DC residents on their payroll to those state agencies.

This reporting is a heavy burden for entities that have headquarters in one of these two states, but employ workers at locations across the country. They are required to file for all of these employees.

It is also tricky for employers of other states who don’t realize that they have to file for their employees that reside in New Jersey or DC.

Do You Need A State Filing Solution?

If state filing is something you don’t want to worry about, ACAwise is your best choice! ACAwise software is configured to automatically file to state agencies.

The IRS recommends that you file electronically and the state of New Jersey and District of Columbia flat out requires it. With ACAwise you can e-file easily and accurately. Our clients take comfort in the extensive error checks that are embedded within the ACAwise software suite.

Reach out to an ACAwise expert today to get started on your ACA reporting!

Leave a Comment