Estimated reading time: 8 minute(s)

Many states require ACA reporting on the state level even after eliminating federal individual mandates under the Affordable Care Act (ACA) by Congress. This adds up to extra stress and administrative work for any employers who operate in or employee workers who reside in these states.

One of these states is Massachusetts. They have been requiring health coverage reporting on the state level even before the ACA was created.

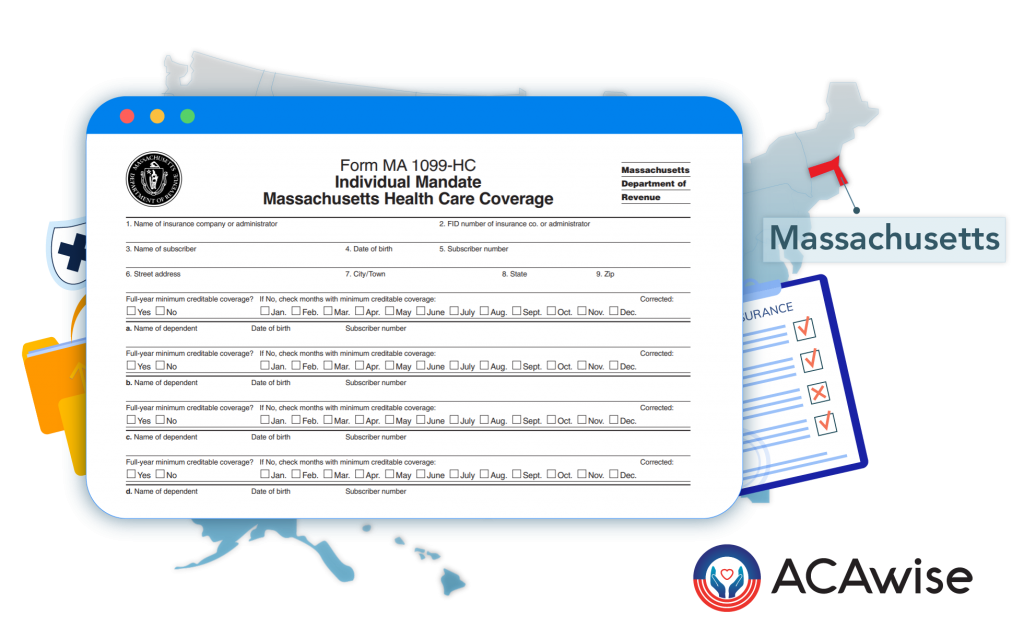

What is the Form MA 1099-HC?

The Form MA 1099-HC is used to report the health insurance coverage of individuals over 18 residing in the state of Massachusetts. This state tax form acts as proof that an individual had the required level of health insurance.

Because the Commonwealth of Massachusetts has an individual mandate in place, residents will need this form to complete their state income taxes and avoid a penalty and prove that they had the minimum health coverage required.

This form is generally distributed by insurance carriers, however, employers whose insurance companies don’t distribute these forms will need to take responsibility and distribute this form to their employees.

Here is a guide to filing the mandatory Form MA 1099-HC.

When is the deadline to file Form MA 1099-HC?

The Form MA 1099-HC must be filed before these deadlines to avoid unwanted penalties. Form MA 1099-HC due date is given below:

- The deadline to distribute copies of MA 1099-HC to employees is January 31, 2022.

- The deadline to submit MA 1099-HC forms to the State of Massachusetts is March 31, 2022.

What information is needed to file Form MA 1099-HC?

The following information must be included on Form MA 1099-HC:

- The name and Federal Tax ID of the responsible insurance company or administrator.

- Information on the primary subscriber, such as their name, subscriber number, DOB, and address.

- The coverage period when the minimum creditable coverage was offered to the subscriber and their dependents.

- If the employee was covered for all 12 months of the year, you must check the box full-year minimum creditable coverage.

- If the employee was not covered for all 12 months of the year, check the boxes against the months the minimum creditable coverage was offered.

How do employers submit Forms 1099-HC to the DOR?

The Massachusetts Department of Revenue does NOT permit the paper filing of Form MA 1099-HC. These forms must be filed electronically.

What are the penalties for Failure to File Forms MA 1099-HC?

Employers who fail to submit MA 1099-HC forms will be subject to a $50 penalty per individual, which can reach a maximum of $50,000.

There is no official update about the Massachusetts state reporting deadline penalty.

Meet your MA Form 1099-HC Filing Requirements with ACAwise

ACAwise is here to help! Not only do we take care of your federal ACA reporting requirements, but we can help you meet your state requirements as well! We can electronically file your MA Form 1099-HC with the Massachusetts Department of Revenue. We can also handle the distribution of your employees’ copies.

Leave a Comment