Latest

business tax extension

Don't miss your last chance to extend your business and personal tax deadlines and avoid late filing penalties. Act now!

Read More

aca deadline

Need to file but can't make today's deadline? Read this blog for your next stepd!

Read More

aca health insurance

Today marks the 14th anniversary of the Affordable Care Act! Join us as we delve into its impact and the associated reporting obligations

Read More

ACA Reporting Deadline

Today is a major ACA reporting deadline for the 2023 tax year. If your business has missed this milestone, here are some tips for course correcting in time

Read More

Uncategorized

There are some important ACA State Deadlines today, learn which ones and how to get started!

Read More

ACA e-file provider

ACAwise stands ready to assist businesses in meeting their compliance requirements - starting with these MA & CA state deadlines!

Read More

aca reporting requirements

Before you ring in the new year - put a plan in place for Tax Year 2023 ACA Reporting. ACAwise is here to help!

Read More

aca 1095 reporting

Learn more about the updated reporting requirements for ACA reporting in 2024!

Read More

1095 b form

Learn what to expect when it comes time to file Forms 1095-B and 1095-C for your organization's ACA reporting!

Read More

aca compliance

A guide to get your business on track with ACA reporting for tax year 2023.

Read More

1095 b form

What's new for your upcoming 2023 ACA reporting?

Read More

ACA penalty notification

No one wants to receive Letter 226J in the mail, but if you do...

Read More

aca reporting requirements

Don't panic if you receive Letter 5699, instead take these steps to respond!

Read More

aca filing penalties

IRS Penalties for ACA Reporting can be steep for employers, learn more!

Read More

1040 deadline

Today is your last chance to file an IRS tax Extension!

Read More

aca 1095 reporting

Today is the ACA Reporting Deadline! What's next?

Read More

business tax extension

Need a last-minute extension for business tax returns? Learn more!

Read More

aca compliance

Choosing the correct ACA Form is the first, most crucial step of the reporting process!

Read More

Uncategorized

ACAwise offers a complete solution to the ACA reporting process!

Read More

Recipient Copy Deadline

Do you offer coverage to residents of California or Massachusetts? You may have a deadline today!

Read More

aca electronic filing

An overview of all the ACA deadlines in 2023!

Read More

ACA e-file provider

Read this article before getting your 2023 ACA Reporting underway!

Read More

ACA Reporting Deadline

The earlier you start preparing for your filing requirements the better!

Read More

ACA information

Required to complete ACA reporting with the State of Rhode Island? Read this!

Read More

ACA information

Will this affect your upcoming 2022 ACA reporting?

Read More

affordable care act penalties

Learn more about the future of IRS penalties for ACA reporting.

Read More

affordable health care

Learn how a lower affordability rate could affect your company's ACA reporting.

Read More

1095 recipient forms

Learn about the simple process!

Read More

aca electronic filing

Another way that ACAwise has your ACA reporting needs covered!

Read More

1095-c codes

An overview of "Offer of Coverage" Codes.

Read More

business tax extension

A guide to e-filing your last minute extension!

Read More

ACA e-file provider

This is crunch time for the ACA Reporting season!

Read More

aca reporting deadlines

What does your state require?

Read More

1095 b form

Understanding which 1095 form applies to you.

Read More

1095 recipient forms

What does your state require?

Read More

aca employer reporting

How does the ACA treat School Districts?

Read More

aca reporting

ACAwise simplifies your ACA reporting from start to finish!

Read More

aca reporting

Learn more about mandated ACA reporting to the state of Rhode Island.

Read More

aca filing

In the early years of the Affordable Care Act (ACA), there was a federal individual mandate. This mandate required taxpayers to acquire and maintain a health insurance plan

Read More

State Filing

ACA reporting is one of the required tasks for employers to take on, now that many states are instituting state mandate ACA reporting after eliminating the federal individual

Read More

Form 1095-C

The latest updates to the ACA recipient copy deadline.

Read More

Form 1095-C

Start off your ACA reporting with this helpful information!

Read More

1095 recipient forms

IRS updates and deadline requirements for your 2021 ACA reporting.

Read More

aca reporting

What Applicable Large Employers need to know!

Read More

1095 c

Since the federal individual mandate was eliminated by Congress, there has been a lot of movement at the state level. Many states have implemented their own individual mandates

Read More

individual mandate

Here is a guide to filing the mandatory Form MA 1099-HC.

Read More

IRS Updates

How could this affect your future ACA reporting?

Read More

1095 c reporting

Updates for reporting an ICHRA in 2021!

Read More

1040 deadline

Tax Day is on the way!

Read More

irs deadline

File your Form 7004 in minutes!

Read More

ACA Reporting Deadline

The benefits of filing an 8809 extension.

Read More

ACA information

Determining your ALE status.

Read More

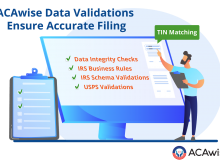

ACA data

Resolving incorrect TINs

Read More

1095 deadline

March 2, 2021 is almost here!

Read More

aca reporting

The season is here, how are you handling reporting?

Read More

1095 recipient forms

We will print and postal mail your recipient copies for you!

Read More

aca reporting

Simple, secure ACA reporting.

Read More

aca compliance

ACAwise offers flexible e-filing solutions.

Read More

ACA data

These data validations are the key to error free filing!

Read More

aca reporting

The new year is here and we’re all ready to put 2020 behind us. Applicable Large Employers are ready to get their ACA reporting behind them as well.

Read More

1095-c filing requirements

Form 1095-C is a tricky one. At first glance, it may be overwhelming, especially because employers must complete one of these forms for each of their full-time employees.

Read More

Thanks Giving

We wish you a safe and happy Thanksgiving!

Read More

1095 codes

New ACA codes for 2020 explained!

Read More

1095 c form

Here is the key information employers should know about Form 1095-C.

Read More

aca reporting deadlines

What mandated reporters need to know going into 2021.

Read More

ICRHA

Are you interested in offering your employees an ICHRA, but you aren't sure where to start?

Read More

ACA Reporting Deadline

There have been so many IRS changes to deadlines and forms in 2020, that it has been hard for business owners to keep up. Here at ACAwise, our

Read More

Letter 5699

Here is what you need to know to keep one of these letters out of your mailbox.

Read More

affordable health insurance

Calculate your ICHRA Affordability with ACAwise!

Read More

aca compliance

The key to avoiding these penalties is using safe harbors.

Read More

ACA Reporting Services

ACA Core vs ACA Elite: Which should you choose?

Read More

aca employer reporting

As an employer, there is so much to keep up with in order to maintain your compliance with the IRS. When it comes to meeting your ACA reporting

Read More

ACA Penalty Calculator

The following information will understand the Employer Shared Responsibility Payment (ESRP) and calculate any potential ACA penalties you may face.

Read More

aca filing penalties

This is what you need to know about Letter 226J in order to handle it properly.

Read More

1095 c form

Find out how "safe harbors" can help you maintain your IRS compliance.

Read More

aca compliance

Although they may be the last thing on your mind, the ACA reporting requirements aren’t being put on pause.

Read More

health insurance coverage

Choosing health insurance coverage that fits your employees’ needs is a crucial decision.

Read More

1095 c reporting

A Safe Harbor is a method by which employers are able to prove that the health insurance that they offered to their employees was affordable.

Read More

1095 codes

As this option increases in popularity the IRS will likely require additional information from mandated ACA reporters for tax year 2020.

Read More

1095 c form

On July 13, 2020 the IRS released new drafts of the ACA Forms 1094-C and 1095-C. As these forms are drafts, it is possible that the IRS will

Read More

aca 1095 reporting

If you are overwhelmed by the IRS reporting requirement and ACA compliance seems out of reach, consider finding a reporting provider.

Read More

aca 1095 reporting

With the following tips you can avoid common errors in ACA filing and stay calm, cool, and IRS compliant!

Read More

minimum essential coverage

Let’s take a moment to consider this term and its definition, you’ll see that “MEC” applies to everyone.

Read More

health insurance coverage

As restrictions begin to ease and Americans are able to resume more areas of their lives, now is a great time to explore your health insurance coverage.

Read More

Current Events

What is this Act and what effects could it have on the ACA in the future?

Read More

health care news

The IRS is increasing flexibility when it comes to Cafeteria Plans under Section 125 of the Internal Revenue Code.

Read More

Current Events

Let’s talk about Antibody testing. What is it and how important is it to you and your employees?

Read More

health care news

Here is the information that you need to know to make the most of what telemedicine is offering right now.

Read More

health care news

Americans are wondering what effect COVID-19 will have on their health insurance plans.

Read More

Current Events

In early May, the State of California brought a lawsuit against both Uber and Lyft. These companies are major players in the gig economy, creating jobs that Americans

Read More

aca compliance

As the IRS continues to release penalty notices for prior tax years, more and more organizations may find themselves in trouble. That’s why you should know that prior

Read More

ACA information

Have you heard of the ABC Test? Many states have begun to adopt it.

Read More

ACA news

What are they? Why are they important? Why is the Supreme Court involved?

Read More

business owners

You will need to take the following into account when you are considering the path to reopening.

Read More

monitor aca compliance

Wow, that was a long ACA reporting season...how can we make next year easier?

Read More

business owners

Here is what you need to know to apply for PPP

Read More

ACA reporting software

Here at ACAwise, we are proud to serve a number of different types of businesses entities across a wide variety of industries.

Read More

aca compliance

Here at ACAwise, we are proud to serve a number of different types of businesses entities across a wide variety of industries.

Read More

business owners

Keeping the positivity flowing through your business in the best of times can be a challenge. So how do you do it right now?

Read More

e-file form 8809

Are you drowning in data and unsure where to start?

Read More